2024 Reverse Mortgage Limits Skyrocket

"Some of the best things that happen in life will not be on your schedule." –Unknown

Dear Friends,

This is such a fantastic way to begin the new year!!!!

Interest rates are beginning to sneak back down AND last weeks exciting HUD announcement: THE INCREASE IN THE HECM LOAN LIMIT TO $1,149,820.00, will certainly make for new and exciting opportunities!

If you or someone you know applied for a reverse mortgage last year, the actual numbers may have not been favorable. The changes announced last week will undoubtedly bring about new benefits and would be worth your time to take another quick look.

It would be my pleasure to speak with you to review your current loan status. Let's explore the possibilities and benefits that may exist given these changes!!!

2024 HECM Limits Announced:

Every year, HUD reviews the national reverse mortgage lending limit for the HECM program and determines the amount based on home prices for the preceding year.

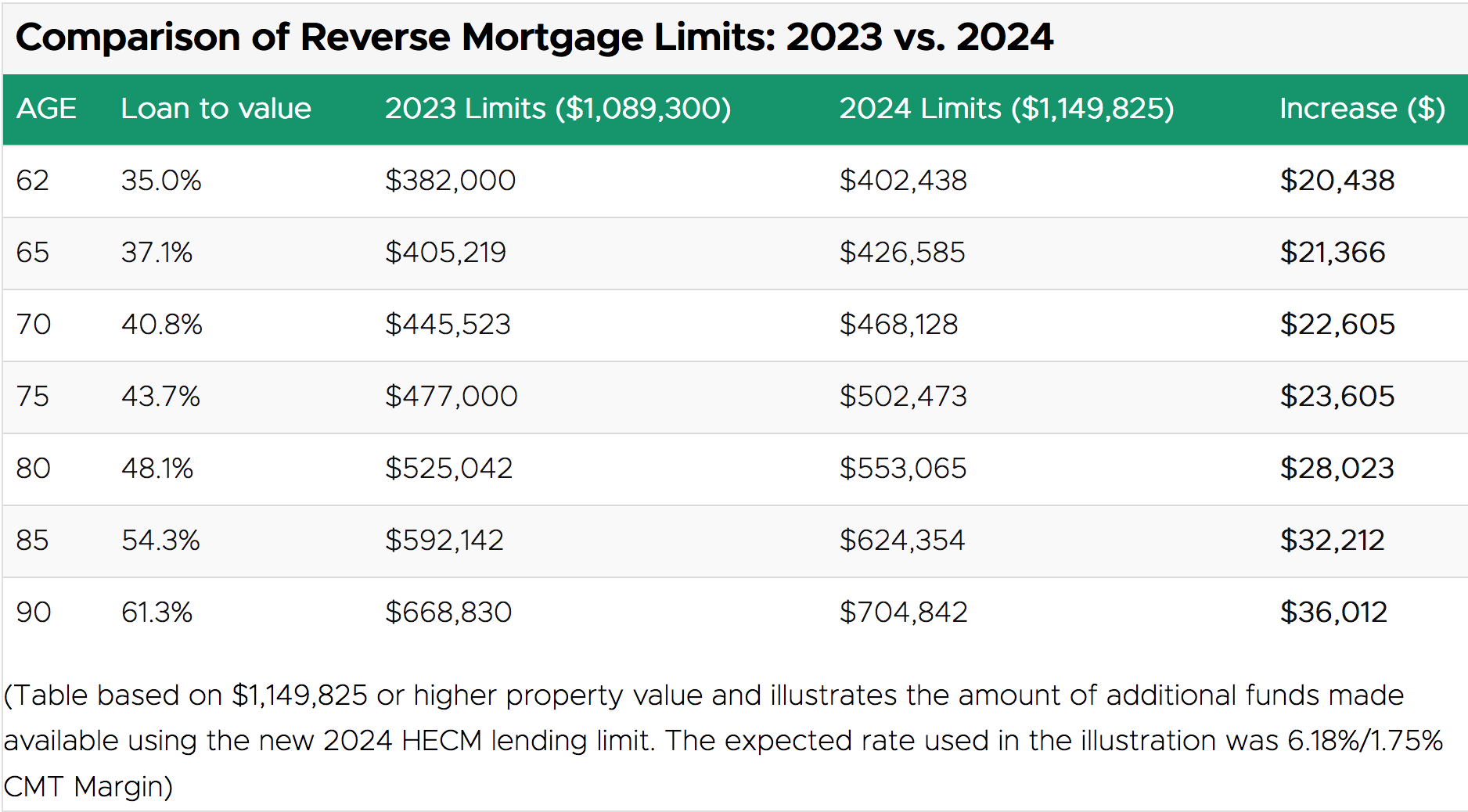

The Federal Housing Administration has just announced that it will increase the maximum claim amount for Home Equity Conversion Mortgages in calendar year 2024 from $1,089,300 to $1,149,825, effective for case numbers assigned on or after January 1, 2024.

History of HECM Lending Limits

HUD Lending limits typically move with home values. After the change in 2008 that first moved the lending limits to a national limit of $417,000 (from regional limits based on regional values), the limit took another significant increase in 2009 to $625,500 due to the Housing and Economic Recovery Act.

During the pandemic, property values continued increasing and in 2021 the HECM limit increased to $822,375.00 representing an increase of $56,775.00. Then in 2022, we experienced massive and unprecedented housing price growth and the HUD limit grew yet again to $970,800.00 a single increase of $148,425.00

In 2023 the HECM lending limit saw another substantial increase, reaching $1,089,300.00. This significant rise reflects the ongoing growth in housing prices and market dynamics.

These continuous increases indicate a robust housing market and provide more opportunities for borrowers seeking reverse mortgages.